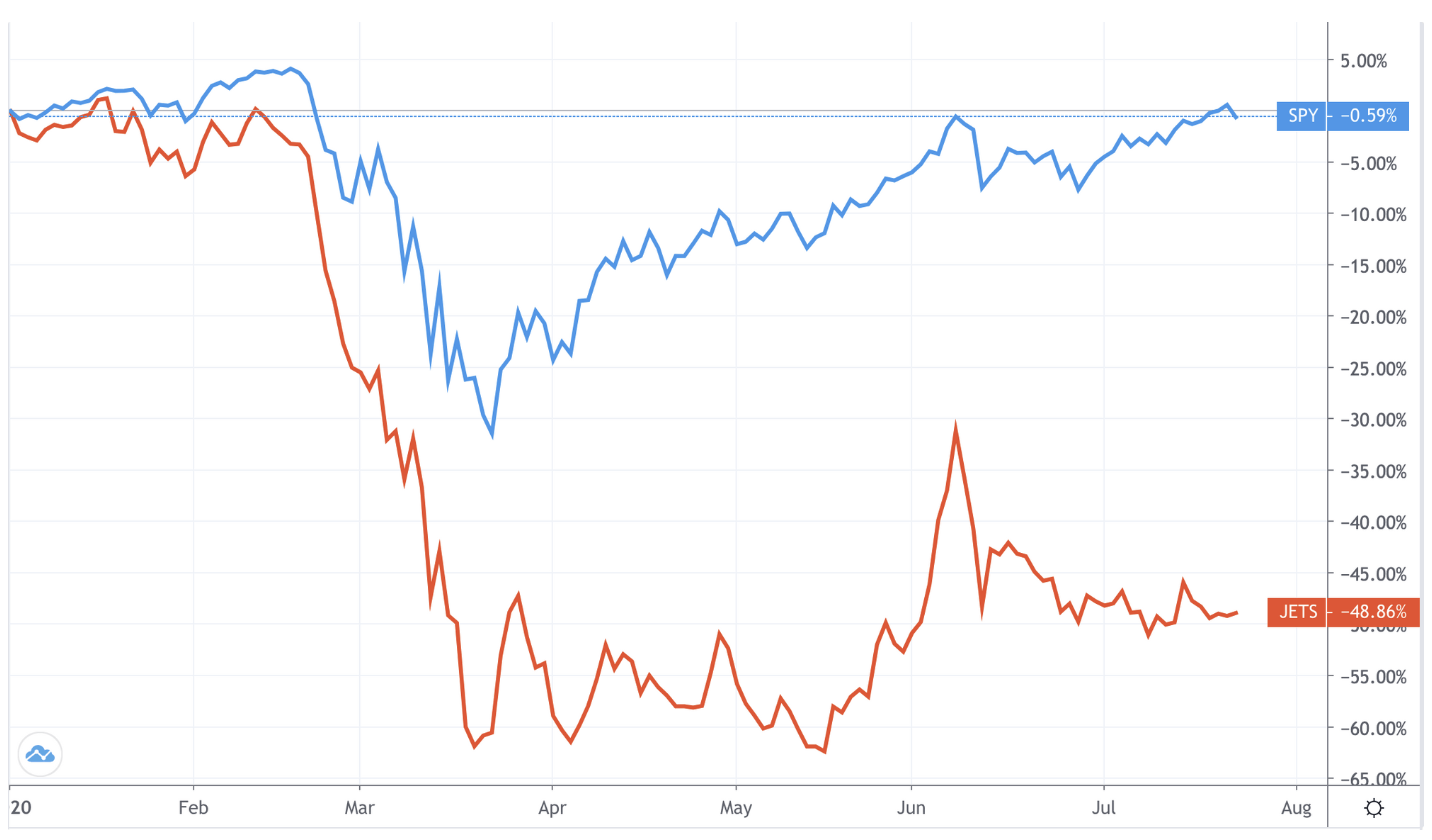

The coronavirus pandemic situation has made a big problem for the growth of the airline industry. The NYSE: LUV stock at https://www.webull.com/quote/nyse-luv, which is from one of the best airline companies, has become popular among a lot of the investors in the previous year. But in the current year, the stock has met a huge drop in the price of it. Thus it is a good one for the people to make good analyses with the top experts and also with the other stock peoples to make a good investment decision.

Drop In The Earnings

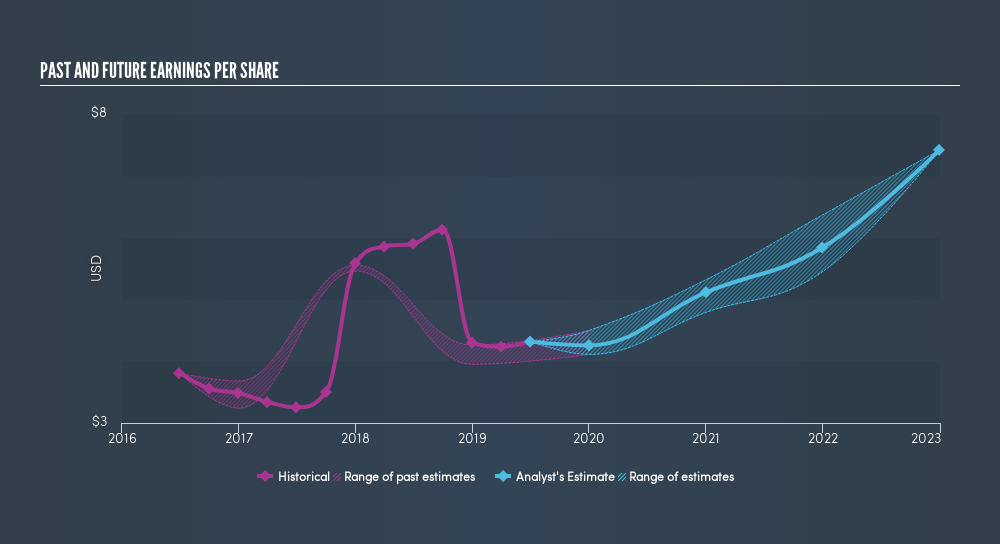

The airlines have consecutive increment in revenue for the past many years. But after the global pandemic, the revenue growth has been rising from the sudden drop. But according to the analysis, the company has faced a twenty percent of the revenue drop in each and every year. This means that earnings will be decreased and also the revenue will face the decrement. Thus it is not easy to maintain and recover from the drop that is faced. So if you are the person having invested in this stock, then you have to be more careful. You can either simply hold the stock or better to avoid the NYSE: LUV stock purchase.

Best For Long Term Investment

The stock price will not be improved suddenly as this will take some amount of time. According to the company, it is having confirmed that the stock price will back to the previous form during the third quarter. The company’s first-quarter results have clearly indicated that it is much riskier in the previous month. Even though the investment in the NYSE: LUV stock has the riskier option, you will find this stock to the best one for the long term period. Because of the drop in the air travel industry made the company to receive the drop in the value stock like NYSE: NCLH. If you are decided to invest in this stock, then it is not a bad decision as you need to face the risk.

Reason To Buy Or Sell Right Now

The firm is have made a steep increase in the economy, which is about fifty billion dollars in debt and equity financing. The company believes in recovery from the drop in the upcoming year, and so it will be stable in the fiscal year. So it is better to buy it. Even though the partial release in the lockdown still the most of the school or the colleges and also the workers are present in the home only. Thus the vacation trip was a little bit soared, and the employees will get removed.

Disclaimer: The analysis information is for reference only and does not constitute an investment recommendation.